Portfolio Construction Series - Part Four

Infrastructure – Every home should have some

by Colin Campbell - Managing Director

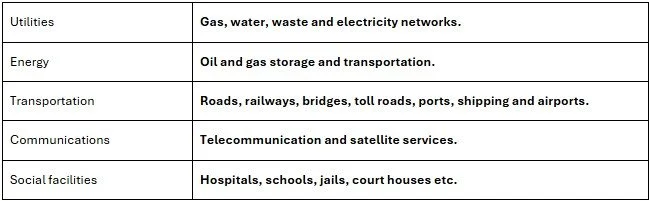

What is Infrastructure?i

Infrastructure is defined as the physical and now digital assets that we cannot live without.

Traditionally, component investments would fall under the following headings.

The defining investment feature for the infrastructure asset class was:

Investments with predictable risk profiles and strong, consistent returns, even through volatile markets, economic cycles and inflationary conditions. Traditionally these have been physical assets.

Infrastructure investing involves owning a part of these essential assets, holding the rights to their use and benefiting from the income generated as society pays to use those resources1. These income-producing assets are built for long-term use, requiring large capital spending initially and smaller ongoing costs to sustain their operations.

Why is Infrastructure attractive?

A defining feature of infrastructure assets is their high barriers to entry. Infrastructure companies are often operating as a monopoly or in a duopoly. In most instances, governments grant exclusive rights for specific assets to a chosen firm rather than allowing multiple firms to operate similar assets and compete for market share. This regulation aims to ensure efficiency and profitability, preventing scenarios such as having (e.g.) several electricity networks, toll roads etc competing etc in a single city/market. Generally, Governments regulate the prices charged for services attached to these infrastructure assets to ensure a balance between the owners receiving an attractive return on their capital and offering fair prices to the public.

Infrastructure investing has long offered investors the benefit of sitting in between growth and defensive asset classes. Infrastructure investments are known to offer steady and reliable cash flows to investors. Revenues generated are often secured through long-term contracts with creditworthy entities, generally government bodies.

The services provided by infrastructure firms exhibit inelastic demand i.e. consumption patterns are largely unaffected by price fluctuations or economic cycles. They are often essential services which are relatively recession-proof compared to companies in sectors such as retail.

Also, many Infrastructure cash flows offer a hedge against rising inflation. This is through

regulated fees that undergo annual Consumer Price Index (CPI)-based adjustments, often the case with airports or toll roads.

directly passing on higher costs to the consumer through increased prices, as is common with utility companies. This is a function of being a monopoly or duopoly with pricing power.

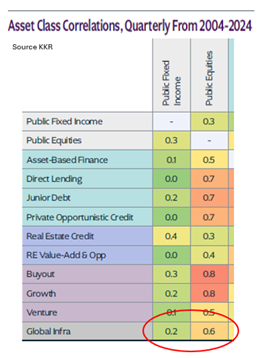

Diversification from traditional asset classes

As an asset class, listed infrastructure companies typically have a low correlation to traditional asset classes like equities and bonds due to the above-mentioned characteristics.

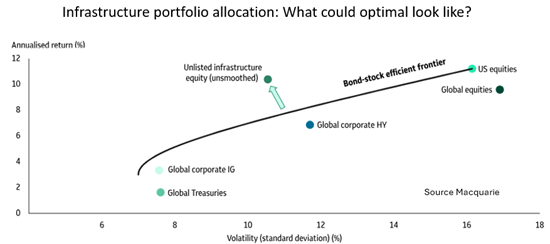

Also, research finds that integrating global infrastructure to a portfolio has the potential to increase returns while diversifying risk1.

Why the growth? - The demand side

Shifting demographics. In the case of Australia, large scale immigration and urban expansion has meant an increased demand for services and physical assets.

Changing technologies has seen rising demand for services like mobile telecommunications, high-speed internet, data centres etc.

Globally, Transportation is driven by growing populations and increased demands for quality infrastructure by the growing middle and upper classes.

Covid changed transportation and communication preferences.

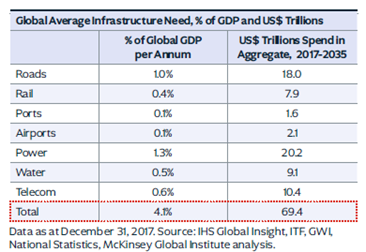

Plenty of articles have been written about the decay of the developed world infrastructure as against emerging economies such as China . This underinvestment in infrastructure in the developed world over the last thirty years has created what is known as an “infrastructure deficit.” These factors are predicted to lead to infrastructure investment of over US$94 trillion by 2040, predominantly in the form of Government driven policy initiatives1. For example, in the US we saw the passage of two landmark bills - the Infrastructure Investment and Jobs Act in 2021 and the Inflation Reduction Act in 2022.

KKR in its latest Insight publication[i] identifies the post-pandemic increase in the need for infrastructure, where demand for capital far exceeds what governments can provide for transmission lines, connect data, build supply chain resiliency, and update existing infrastructure. US$3.7 Trillion per year of investment in economic infrastructure is needed to 2035 to keep pace with expected GDP growth.

Why the growth? - another lens.

In a paper from McKinsey, they commented that Infrastructure’s traditional taxonomy[i] i.e. Components and labels had evolved as the infrastructure investment sector matured. They saw the asset class branching into three categories: super core, core, and core-plus.

Super-core investments are the lowest risk and lowest return. Traditionally, super core has included assets such as regulated utilities, which have regulated tariffs and little volume variation, and availability is usually via public or public–private partnership projects.

Core investments are the next tier up with relatively low risk and low return. Traditional assets in this category have included unregulated oil pipelines and transport-related assets such as toll roads, highways, and airports. New assets such as fibre-optic technology , telecom towers and data centres are now considered core infrastructure.

Core-plus investments carry more risks and can offer returns approaching those of private-equity investments, so showing investment returns at 15% p.a. or more. Such assets mimic the characteristics of classic infrastructure investments but are not universally considered part of the asset class. These may include, Fish and livestock transport, holiday villages, and crematoria.

Playing defence

As a contrast, Andrew Maple Brown[i] saw infrastructure investing requiring a tight definition to deliver the defensive attributes that investors are targeting. The most significant factor that impacts the defensiveness of the sector can be found in the very definition itself. It is proposed that core infrastructure investing requires an approach that looks beyond the physical attributes of a security and instead delves into the commercial frameworks in which the assets operate.

One of the main risks to Infrastructure assets is rising interest rates and over gearing. As most infrastructure assets have the feature of stable cash flows and are more immune to the economic cycle, they generally have more debt on balance sheet than their industrial counterparts. Rising interest rates on a geared balance sheet does cause valuation pressures. So, they will behave like a long duration bond and underperform in this scenario.

New Trends

An emergent growth area in Infrastructure has been Data Centres. Crossing over with the Property Asset class, the strong demand in AI has seen this sub asset class explode. The asset manager Brookfield predicts that US$7trillion of AI Infrastructure needs to be built, of which Data Centres alone with be $2trn and poles and wires $500bn. Mostly using private money looking for stable, risk adjusted returns akin to a utility style investment.[i]

Accessing the market

In Australia, infrastructure investing was traditionally seen as represented through ASX listed utilities, toll roads, etc. Being attractive assets with global audience, a series of takeovers have seen the number of ASX listed companies and trusts in this space fall (vale Spark, Connect East, Sydney Airports etc.), leaving a smaller number of heavy weights such as Transurban, APA, Atlas Arteria and Qube. Stocks such as AGL and Origin have infrastructure assets but also have large retail businesses so do not provide a clean exposure to infrastructure.

So, to gain better access to the infrastructure class we recommend that clients consider a considerably broader universe by adding local unlisted as well as global listed and unlisted exposure. This can be done through listed stocks, funds as well as managed funds specialising in the unlisted space.

Asset Allocation

In asset allocation terms, Infrastructure often gets lumped in with Property in client portfolios. Is a hospital infrastructure or property? – yes, the lines are blurred. We see Property and Infrastructure as having different drivers and advocate a separation and should be treated as an asset class in its own right. With a wider range of listed, unlisted local and global assets the argument is robust for this treatment.

How much should you allocate to Infrastructure? In a recent AFR article one expert proposed a 10% weighting in a family office style portfolio[i]. For those a little below a Family Office in size, we would start with a portfolio holding of around 5% and range higher from there depending on risk profile, liquidity needs, asset mix and client specific considerations

[1] https://www.macquarie.com/au/en/about/company/macquarie-asset-management/institutional-investor/insights/infrastructure-portfolio-allocation.html#:~:text=Infrastructure%20and%20efficient%20frontier%3A%20Unlocking,a%20defined%20level%20of%20risk.

[1] KKR Mid-Year outlook for 2025 “Make Your Own Luck”.

[1] https://www.mckinsey.com/industries/private-capital/our-insights/infrastructure-investing-will-never-be-the-same

[1] https://maple-brownabbott.com/infrastructure-investing-needs-a-tight-definition/

[1] https://www.afr.com/chanticleer/brookfield-wants-the-boring-slice-of-the-10trn-ai-boom-20250807-p5ml8k

[1] https://www.afr.com/wealth/investing/how-infrastructure-became-the-quiet-driver-of-portfolio-growth-20250717-p5mfo6

Disclaimer: This information is provided by Carnbrea & Co Limited ABN 33 004 739 655, Australian Financial Services Licence No. 233763. Any advice included in this document is general in nature and does not take into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it is appropriate to you. If a product we recommend has a Product Disclosure Statement (PDS) or a Prospectus, you should read it before making a decision. Past performance is not a reliable indicator of future performance. Derivatives are leveraged products which means gains and losses are magnified and you may lose substantially more than your initial investment. We do not endorse any information from research providers that we provide to you, unless we specifically say so.