Market and Asset Allocation Update – January 2026

CiN-sights Asset Allocation - January 2026

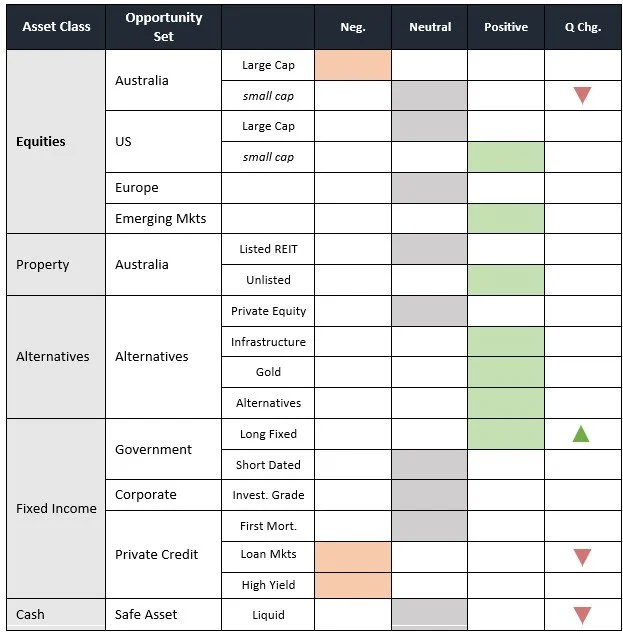

Tactical Allocation Calls (Quarterly view)

Thought

“I think you should have an asset allocation mix that assumes that you don’t know what the future will hold” Ray Dalio

Thoughts

Australian Equities: Whilst at first glance, Australian equities might seem like a cyclical play that would benefit from an acceleration in global growth, they remain too expensive relative to their profitability. Prime example is the Banking sector with the PE expansion having run its course. Resources have rebounded as global investors hunt for real assets, but a tepid China will ultimately temper the run. Small caps have done well but are now struggling to make fresh highs. We see better value ex Australia for new monies.

US Equities: Equity markets will continue to mostly ignore geopolitical noise (Greenland, Iran etc) and be primarily concerned with the fiscal 3; monetary policy and unemployment The first two policies remain expansionary, so we remain comfortable with the broad market direction. In the “K” shaped economy, employment is softer but marginally so. The key strategy is in anticipating the rebalancing away from Tech/AI to other sectors i.e timing, magnitude, sector choice etc. Preference is for a staggered diversification to Equal Weight S&P 500, Small Cap sector and more ex-US exposure etc. but not a wholesale exit of Tech stocks and the US. Overall, market valuations keep us at capped at Neutral.

European Equities: With the initial switch to Europe from the US closing the valuation gap, we now move back to Neutral. The Euro market is more a story of Financials and Industrials, so no Tech uplift. Yes, some defense inspired budgetary stimulus helps, but the economic and political framework remains sclerotic (vis a vie France), and it is hard to remain overweight on a sustained basis.

Emerging Markets: We continue to see the EM complex offering a strong risk/reward opportunity. It is part of a longer-term rotation away from the US supported by a global cyclical expansion. We prefer Asian exposure over Latin American as global supply routes get reconfigured.

Property: Our call is unchanged – a stabilisation in bond rates, albeit at a higher level and supportive economic conditions, but find little reason to overweight. We retain a preference to Unlisted opportunities.

Private Equity: Our preference for secondaries funds remains. Given the wide dispersion in performance across managers in PE, the Manager/LP selection remains critical.

Alternatives: As part of our drive to increase diversification i.e. being the major risk mitigant in client portfolios, we continue to seek out offerings either low in market risk or offer low correlation to risk assets. Specialist hedge, commodity and alternative funds are the vehicles of choice here.

Gold: After strong gains, we are still looking for the point where we dial back our holdings, but broad-based buying continues and the momentum factor is strong. Our call on silver and other precious metals exposure has been right, but we are dialling back our exposure here banking some strong gains.

Government Bonds: With long rates having rallied and short rates having factored in as many rate cuts that we can envision, we now dial all FI settings to Neutral. Falling yields in long duration is being offset by term premium increase, anticipated issuance volumes and inflation expectations. Short rates are predicated on lower GDP and higher unemployment which are not yet weak enough to warrant falls in yields.

Private Credit: Spreads are tight, one or two cockroaches have been uncovered, but until we get some serious deterioration in credit conditions $’s will continue to flow. For fixed rate Investment Grade (IG) credit, solid outright yields attract. We become more defensive on positions below IG in the loan markets and see the tight credit spreads not generating sufficient returns for the embedded credit risk.

Cash: Aust cash rates are now at the bottom of the forecast range. We sit at Neutral happy to deploy into Bonds and other assets.

DAA Calls enclosed proposed are for general investment purposes. Please discuss with Carnbrea the suitability of any recommendation to portfolios and the context of client SAA construct, holdings, return analysis and tax consideration. This document has been prepared and issued by Carnbrea & Co Limited ABN 33 004 739 655 (‘Carnbrea’), Australian Financial Services Licence No 233763. Any advice included in this document is general in nature and does not consider your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you. If a product we recommend has a Product Disclosure Statement (PDS), you should read it before making a decision. Past performance is not a reliable indicator of future performance. Derivatives are leveraged products which means gains and losses are magnified, and you may lose substantially more than your initial investment. We do not endorse any information from research providers that we provide to you unless we specifically say so.

Copyright © | 2024 |Carnbrea & Co.| All rights reserved